02.06.2023 |

News

The link between taxation and international migration: Should the tax rate for top earners be lowered to curb migration?

More Finns annually emigrate from the country than return to it. In this article, we will use economic research and comprehensive new data to evaluate the impact of taxation on international migration, assess the situation in Finland and reflect on the policy implications.

More Finns annually emigrate from the country than return to it. Negative net migration may be problematic for society, especially in the case of highly skilled workers who would have high productivity in Finland and who have had a significant amount of public funds used for their education. Due to Finland’s high taxation, there have also been calls to lower the highest income tax rates in particular to curb the international migration of skilled labour. For instance, the report of the expert group on business taxation, published by the Finnish Ministry of Finance, states that ‘the accumulation of human capital as well as both retaining and attracting trained labour to Finland must be incentivised by lowering high marginal tax rates’ (Ministry of Finance publications 12/2017, p. 132, unofficial translation).

In this article, we will examine what can be said about the impact of taxation on international migration based on economic research – including our own new study – as well as assess the situation in Finland. At the end of the article, we will also reflect on the policy implications of the research findings.

The level of taxation and the costs of higher education

Finland is well known for having relatively high labour taxation for high-income individuals. According to the OECD’s Taxing Wages database, the average personal income tax rate for a person who works in Finland and earns 80,000 euros per year was around 39% in 2021. This figure includes employees’ mandatory social security contributions. The corresponding average figure for OECD countries was 34%, and Finland had the seventh highest tax rate out of all OECD countries. In general, however, too much weight should not be attached to international comparisons of this type – it is not at all clear which place should be considered the ‘best’ in such a comparison, especially when taking the role of services funded through taxation into account.

However, comparing the tax rates of different countries is an important consideration when assessing the potential destination countries of international migration flows. High progressive tax rates compared to other countries lead to an incentive for highly skilled Finns with high incomes to emigrate. The Nordic model in which the costs of free education are paid back through progressive taxation can thus be problematic if skilled experts leave the country due to high taxation.

The following numbers illustrate this challenge. High-income individuals are typically also highly skilled. University education in Finland is essentially free to students but expensive to society. According to the OECD’s statistics, basic and secondary education in Finland costs 8,000 euros per student per year, whereas higher education costs 14,000 euros per student per year. The total cost of education for a person completing a master’s degree would therefore be around 170,000 euros (12 years of comprehensive school and general upper secondary school at 8,000 euros per year and 5 years at university at 14,000 euros per year). If the annual earnings of the graduate were 80,000 euros, they would have to work in Finland for five and a half years to pay back the cost of their education. However, if the person were to leave the country for ten years, the loss in tax income would be over 300,000 euros. In the light of these figures, it is easy to understand the worries related to the emigration of highly skilled labour.

An overview of international research

Studies often use migration elasticity to measure the impact of taxation on migration. Migration elasticity refers to the impact that relative changes in disposable income have on migration decisions. If migration were fully independent of taxation, the migration elasticity would be zero and the taxation of top earners, for instance, would not need to be changed on account of its impact on migration. An elasticity value of 1, on the other hand, would mean that taxation has a strong impact on migration and personal income tax rates should probably be lowered to curb migration.

Reliably assessing migration elasticity is important because the elasticity illustrates the impact that taxation – and thus economic policy – has on migration. Focusing solely on the number of migrants does not provide information on how the taxation in different countries compared to taxation in Finland has influenced the migration decisions. Only examining the development of migration flows over a certain period of time, for instance, would provide no information on whether taxation influences the migration decisions or whether migration could be reduced by lowering tax rates. A carefully conducted empirical analysis on the impact of taxation on migration decisions could thus produce important information to support economic policy decisions. A thorough analysis distinguishes the impact of taxation from that of other factors related to migration by, for instance, using tax reforms in different countries to build a credible research design based on a treatment-control comparison.

Existing economic research on taxation and international migration has focused on certain special groups of migrants. Kleven et al. (2013a) studied the migration of professional football players after the deregulation of the European football market. They found that taxation in the destination countries had a strong impact on the migration decisions of foreign players: the migration elasticity of foreign players in the study was around 1. Kleven et al. (2013b), on the other hand, analysed how the preferential tax scheme for highly skilled foreigners introduced by Denmark was reflected in the migration of foreigners belonging to the top income percentile. They, too, arrived at a high estimate for the elasticity: 1.6. Finally, Akcigit et al. (2016) studied superstar inventors – inventors with the most patent citations. Again, the migration elasticity of foreigners was found to be high, around 1. However, all these studies focused on groups of people who are exceptionally mobile and highly skilled.

Ultimately, the high figures that previous research has produced for the elasticity of the aforementioned groups provide no indication of how an average citizen of a specific country will react to taxation or how general income taxation should be changed due to migration. According to a review of literature on the subject by Kleven et al. (2020), studies on the migration elasticity of domestic workers have actually produced estimates close to zero. The elasticity of domestic individuals refers to how the relative share of, for instance, Finns living in Finland (as opposed to Finns living in other countries) changes when the tax rate in Finland is changed.

Based on these findings, Kleven et al. conclude that the preferential tax treatment of highly skilled foreigners is well justified, whereas the taxation of domestic individuals with high incomes need not be changed: ‘…the key point here is that mobility responses across countries are not important for tax policy design unless the tax system targets foreign citizenship.’ Kalin et al. (2019) came to the same conclusion in their report for the Prime Minister’s Office, and based on available data, Finland’s current preferential tax treatment of key foreigners seems like a sensible policy. However, the report by Kalin et al. (2019) only analysed migration at a macro level, and the analysis was limited to examining country-specific factors and the number of people emigrating to various countries. Reliable studies on the link between taxation and migration using full-population, individual-level data have not been available until now.

Findings from a new Finnish study

In our new study, we examine how the differences in income taxation between Finland and OECD countries have influenced the emigration and return migration patterns of Finns. Compared to previous international research, our study is unique especially due to the fact that our data includes the entire working population. The results from Finland are also interesting because of the country’s high income tax rate, which may lead to relatively strong fiscal incentives to emigrate. In addition to the above, we also analyse certain special groups, such as the top decile and percentile of the income distribution as well as various occupational groups that have not been the subject of previous research.

In our analysis, we used data on the education, income and other key socioeconomic characteristics of all permanent residents of Finland from 2003 to 2015. We combined this data with information from emigration registers on whether the individuals included in the data moved abroad during this period, which country they moved into and when, and whether they later moved back to Finland. For those who moved abroad, we had access to data on their income in Finland prior to emigration but not on their earnings abroad. For this reason, we estimated their income abroad based on their characteristics (e.g. age, gender and education) using micro-data from the Luxembourg Income Study (LIS) and the European Union Statistics on Income and Living Conditions (EU-SILC). In addition to this, we compiled data on the tax systems and existing preferential tax schemes for foreigners in different countries during the same period to form an estimate of the tax rate each individual would face in each potential destination country.

Using this data, we analysed how changes in the tax rates and gross earnings in different destination countries influence the migration patterns of Finns, while also accounting for the permanent differences between the countries that are unrelated to taxation. Our chosen research method allowed us to assess the extent to which the migration decisions of Finns are linked to the tax rates in different countries, as opposed to other factors that influence migration decisions.

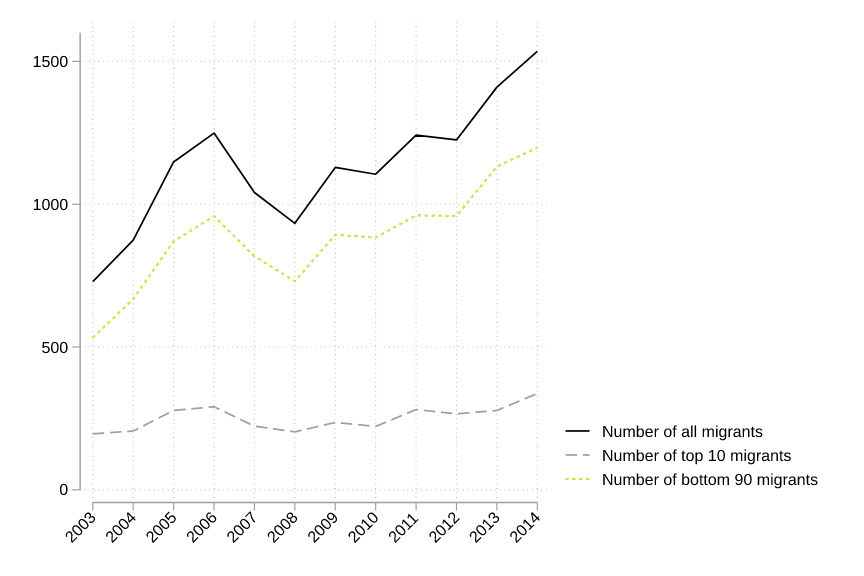

Figure 1 portrays the number of Finns who have moved abroad for at least one year during each year included in our analysis. Figure 2, on the other hand, depicts net migration (emigration – return migration) during the same period. The net emigration of individuals in the top decile of the income distribution has remained at around 50 people per year throughout the period, whereas emigration among other income levels has increased. According to Figure 3, migrants do not seem to have chosen primarily low tax countries as their destination, given that popular destinations – even among high-income individuals – include countries with high tax rates.

The actual detailed empirical analysis using the method described above indicates that an individual’s net-of-tax rate (1 – theaverage tax rate on their income) has the expected positive impact on the migration decisions of Finns. However, the magnitude of this impact is negligible. Even for the top income decile, the migration elasticity is very close to zero. The estimated migration elasticity increases towards the very top of the income distribution but still remains very low. Furthermore, a high tax rate does not seem to reduce return migration among Finns.

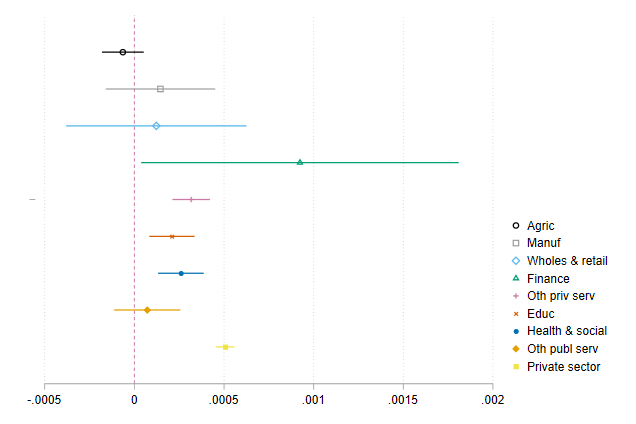

In contrast to previous research literature, our data also allows us to examine various occupational groups separately. Figure 4 depicts the estimated migration elasticities of various occupational groups. The findings seem to indicate that, on average, the strongest responses to taxation can be seen in the migration decisions of people working in the finance sector, and the average response to taxation appears to be slightly larger among workers in the private sector than among those in the public sector. However, the migration elasticities for all sectors are very small, and differences between the different sectors are predominantly not statistically significant. To highlight one sector that is often considered of interest in the public discussion, the migration decisions of healthcare professionals do not appear to be influenced by taxation.

Policy implications

Neither international research nor our new analysis seems to support the need to lower the highest national marginal tax rate in Finland on account of the emigration of labour. Based on our study, however, continuing the preferential tax treatment of foreign experts appears advisable. Our study only focused on the potential impact taxation has on emigration, but migration is naturally affected by public expenditure, as well: high-quality public services may reduce the possible negative incentives of taxation. Emigration combined with return migration may also lead to an overall increase in knowledge and skills, which is likely to be reflected in public tax revenue.

Sources

Akcigit, U., Baslandze, S. & Stantcheva, S. (2016), ‘Taxation and the international mobility of inventors’, American Economic Review 106(10), 2930–81.

Kleven, H. J., Landais, C. & Saez, E. (2013a), ‘Taxation and international migration of superstars: Evidence from the European football market’, American Economic Review 103(5), 1892–1924.

Kleven, H. J., Landais, C., Saez, E. & Schultz, E. (2013b), ‘ Migration and Wage Effects of Taxing Top Earners: Evidence from the Foreigners Tax Scheme in Denmark’, The Quarterly Journal of Economics 129(1), 333–378.

Kleven, H., Landais, C., Muñoz, M. & Stantcheva, S. (2020), ‘Taxation and migration: Evidence and policy implications’, Journal of Economic Perspectives 34(2), 119–42.

Photo: Jonne Renvall, Tampere University