07.06.2024 |

Research

Risk-based tax audits lead to increased likelihood of forced exit among non-compliant firms

A study by Jarkko Harju, Kaisa Kotakorpi, Tuomas Matikka, and Annika Nivala analyzes how firms respond to risk-based tax audits, using administrative data on all Finnish firms. The study finds persistent improvements in tax compliance, and an increase in the likelihood of forced exits for non-compliant firms after a tax audit.

Risk-based tax audits are a central tool in regular tax enforcement. A study by Jarkko Harju (Tampere University), Kaisa Kotakorpi (Tampere University), Tuomas Matikka (VATT), and Annika Nivala (VATT) analyzes firm responses to risk-based tax audits using administrative full-population data on tax audits and tax returns in Finland. The study finds an immediate and persistent increase in reported profits by the audited firms after being audited compared to matched non-audited firms with a similar development in key outcomes before the audit. Reported profits increase on average by 12 % during a five-year follow-up period. This response is an indication of significant non-compliance in the baseline.

The study also examines the anatomy of non-compliance: what are the strategies that firms use to reduce their tax payments? The results indicate that both revenue and labor costs increase after audits, indicating that there was under-reporting in the baseline. This suggests that some firms may follow a strategy of under-reporting their overall scale of operation, which lowers tax payments both on the profit tax and on payroll taxes. The study also examines the anatomy of non-compliance: what are the strategies that firms use to reduce their tax payments? The results indicate that both revenue and labor costs increase after audits, indicating that there was under-reporting in the baseline. This suggests that some firms may follow a strategy of under-reporting their overall scale of operation, which lowers tax payments both on the profit tax and on payroll taxes.

These changes in firms’ reporting behavior add significantly to the tax revenue generated by tax audits, over and above the unpaid taxes uncovered directly in the audit: the reporting responses following an audit make up about one third of the total tax revenue generated by audits.

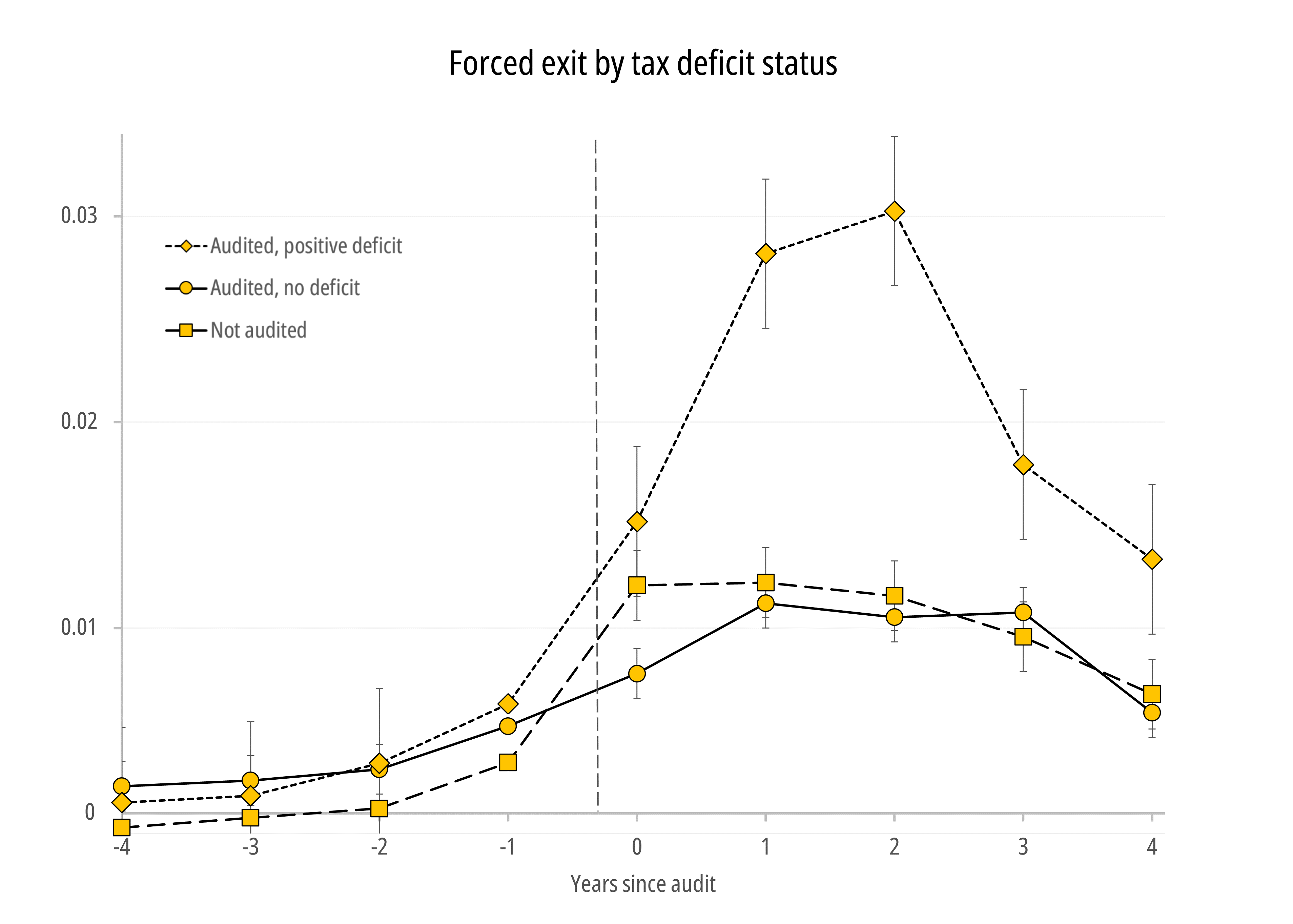

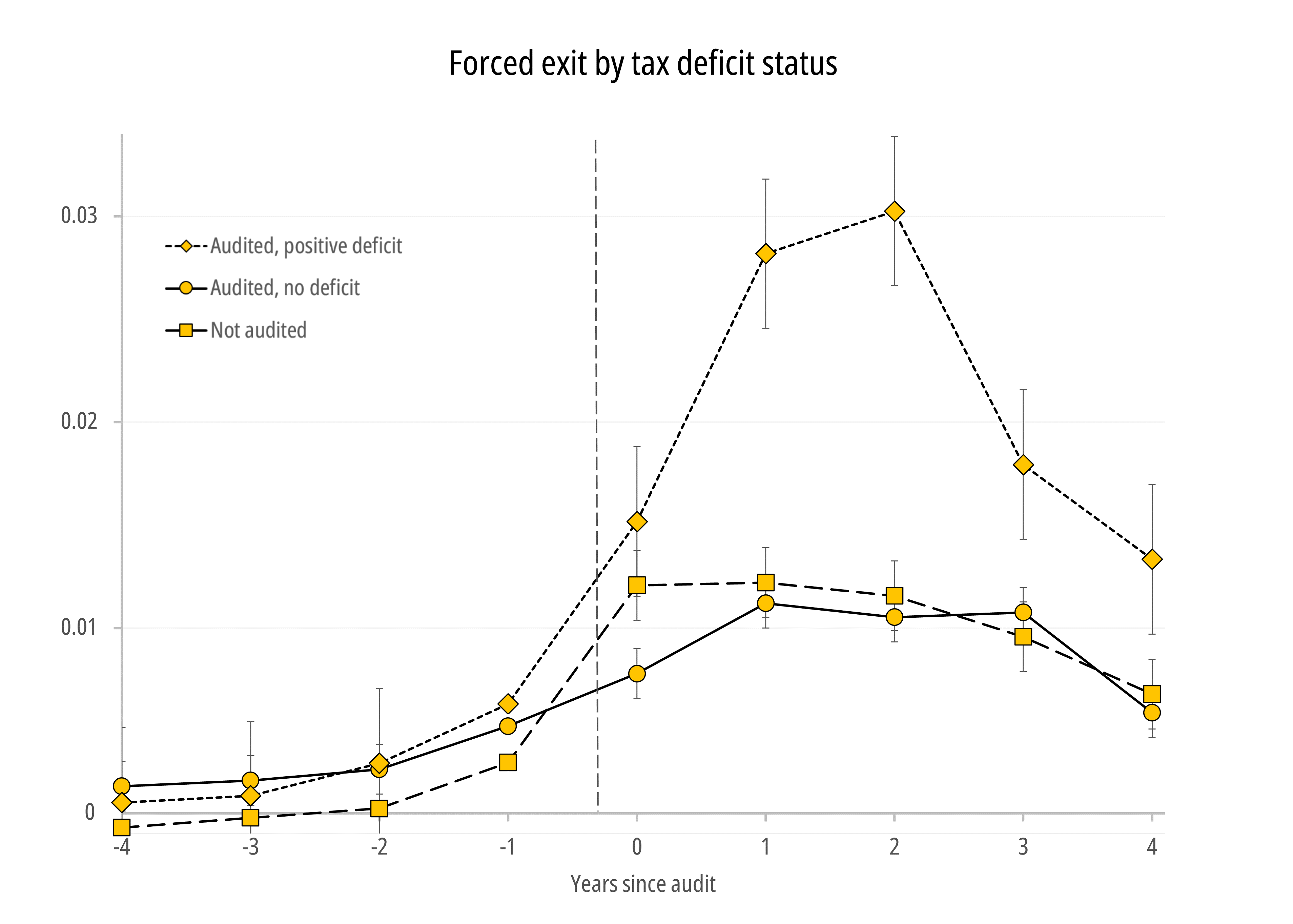

Further, the study uses novel data on bankruptcy petitions and court decisions to investigate whether stricter tax enforcement has implications for real economic activity. The study finds a large increase – of about 39 % — in the likelihood of bankruptcy after audits among non-compliant firms. No increase in bankruptcies is found for compliant firms. This suggests that in addition to tax revenue gains, stricter tax enforcement has the additional benefit of shifting market activity from non-compliant to compliant firms.

The full text of FIT Working Paper 22:

Jarkko Harju, Kaisa Kotakorpi, Tuomas Matikka ja Annika Nivala (2024) How Do Firms Respond to Risk-based Tax Audits? FIT Working paper 22/2024.