26.01.2026 |

Research

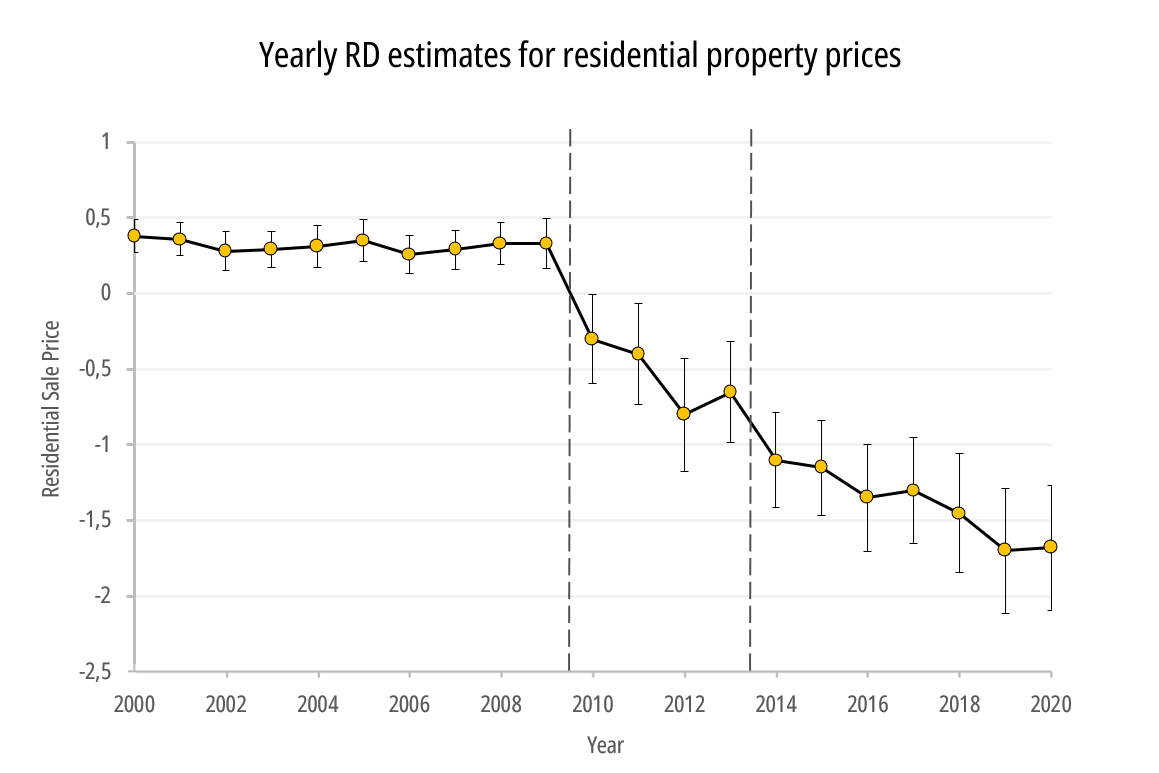

A study by Alessandro Sovera examines how mandatory inter-municipal cooperation affects local welfare, using housing markets as a comprehensive measure of residents’ valuation of local governance.

Read more