20.06.2023 |

Research

Finns’ emigration responses to changes in domestic tax rates are very small

A study by Salla Kalin, Ilpo Kauppinen, Kaisa Kotakorpi, and Jukka Pirttilä examines how sensitive the migration of the Finnish working population is to domestic taxation.

Potential emigration of workers is a key policy concern for high-tax countries. The problem could be especially severe for the Nordic welfare states, because the policy package of free higher education and extensive public services financed by progressive taxation is not sustainable if a sizeable fraction of the high-income, high-skilled population emigrate. Emigration of these individuals would have negative consequences for tax revenue and human capital and hence for the productive potential of a country. Even further down the income distribution, potential emigration of certain occupational groups is of interest for policymakers.

A recent study by Salla Kalin (University of Helsinki), Ilpo Kauppinen (VATT Institute of Economic Research), Kaisa Kotakorpi (Tampere University), and Jukka Pirttilä (University of Helsinki and VATT) examines how sensitive the migration decisions of the working population, including high-income individuals and different occupational groups, are to taxes.

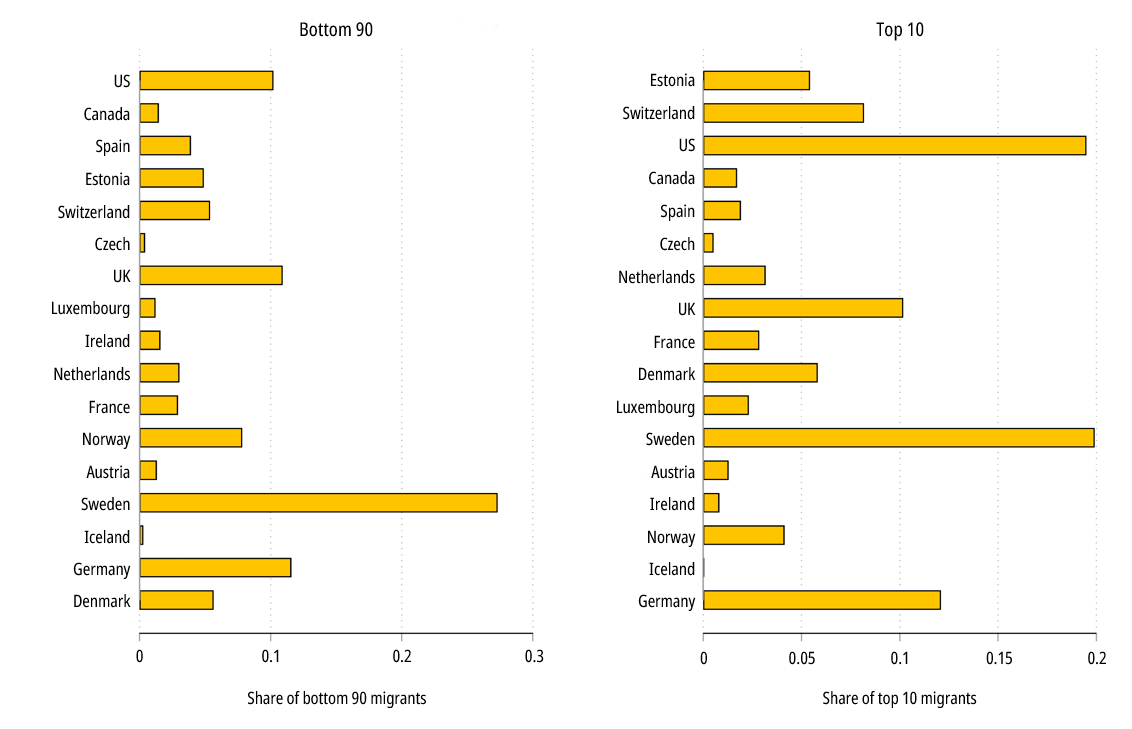

While previous literature has focused on relatively narrow occupational or income groups, the present study examines the relationship between taxes and emigration for the entire working-age, full-time working native population in a source country. The study analyzes the relation between migration and income taxation on two levels. First, the researchers conduct a descriptive macro-level analysis of the relation between stocks of Finnish migrants by destination country and tax rates, analyzing separately those in the top 10% and the rest of wage earners. Then they proceed to an individual-level analysis and study in more detail whether individuals are more likely to migrate to low-tax destinations.

The results imply that the average domestic elasticity of migration with respect to the domestic tax rate is positive and statistically significant, but very close to zero (around 0.001). This holds for workers in the highest income decile as well as for all the different occupational groups analyzed. Moreover, the investigation of return migration patterns suggests that higher taxes at home do not reduce return migration. In line with earlier research, the cross elasticities are slightly higher, around 0.15, with the lower-income groups being somewhat less reactive.

In addition, the study provides the first empirical implementation of the theoretical results of Lehmann et al. (2014), who show that if a fully non-linear income tax schedule at the top is used, the key sufficient statistic for the optimal tax is a semi-elasticity of migration. The estimates of the present study indicate that the migration responses increase for top earners, but remain very small, at least up to the top per mille of income earners.

Full text of FIT Working Paper 1 Migration and Taxation: Evidence from Finnish Full Population Data can be accessed via Publications.